ARMageddon

Damon Darlin ‘s article on variable rate mortages provides another forecast of the impending doom that stalks the real estate market.

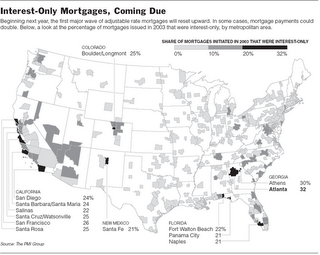

As home prices appreciated from ridiculously high to unbelievably higher, more Americans began using mortgages that allowed them to buy more house for less of a monthly payment. Next year, a large portion of those rates move up and homeowners who opted for the exotic mortgages could find their payments doubled. Talk about bloody. They need to find a way to minimize the pain.

Nothing short then two percocet and bottle of wine will minimize this pain.

With more homes on the market, prices could begin to fall. That reduces home equity — the difference between the amount borrowed and the total value of the home — and could force people whose loans change in 2008 and 2009 to consider selling, further accelerating the drop in prices. Some of those cities with the highest proportions of interest-only loans are also at the greatest risk of falling prices.

As we all know adjustable rate mortgages should definitely be considered the next big bad but it seems a lot of us had no idea what they were getting into. Yeah, these people bought a lot more house for less money but they were counting on appreciation which is as far I am concerned akin to day trading but on a much more slower scale.

Mortgage lenders, however, say they are not worried. Economists say even the worst-case outcome will not have much impact on the overall national economy. Christopher L. Cagan, director of research and analytics at First American Real Estate Solutions, points out that mortgage industry losses of $110 billion spread over several years would amount to a mere 1 percent of the total national homeowners’ equity of $11 trillion and a hiccup in the gross domestic product

I am not an economist. In fact I barely passed that class in high school but I have no idea what the f**k this guy is talking about. All I see is really big numbers and that really scares the crap out of me.

As far as I am concerned Cagan’s statement doesn’t really give me a lot of confidence because he doesn’t seem to be addressing what is going down in the world. First of all oil prices are getting ripped everday because of mounting tensions in the middle east and recently a member fed reserve bascialy that America’s is on the path to bankrupticy. I am sure those homeowners who will have decide to whether to eat or pay the mortgage will take Mr. Cagan’s words to heart.

The mortgage industry is not worried about payment shock. Why?

“It offers an opportunity,” said Brad Brunts, managing director of portfolio management at Citi Mortgage, a unit of Citigroup.

He, like others in the mortgage industry, sees the higher payments as a boost to the flagging mortgage refinancing business. Lenders will adjust about $500 billion in mortgages this year and $700 billion next year, according to Freddie Mac, the quasi-government agency that repackages mortgages for investors. Expect to find the mailbox stuffed with refinancing offers.

Mr. Brunts said only a minority of mortgage holders will face real problems. Most will successfully refinance and though they will pay more, he thinks they will be able to make the payments.

Of course the mortgage industry isn’t worried. Their not the ones holding these mortgages. Their job was done after the deals were closed and the papers were signed. After they collected their fees they had these suckers bundled off and sold to Asia. They already made their money. If people start to default on their mortgages, it’s not their problem it’s the banks.

As for the refi option, well its not an option it is more like a financial death sentence becasue homeowners will be refing at a much higher rate and when they decide to sell any equity that have will probably be wiped out. And don’t get me started on home equity loans.

Over at the Big Picture they did an excellent analysis of the Damon’s article and there was one aspect they pointed out that wanted me to make hurl.

So while the majority of homeowners (and therefore, the lion's share of consumers) are likely safe, there is still the Real Estate market to consider:

In any speculative market, one of the key risks is forced sales. In equities, its when the margin clerks walk around a firm, literally hitting bids indisciminately. Its as per legal/regulatory requirements -- if you don't have the cash in the acocunt -- WHACK!

The scenario laid out above is similar -- on the margins, a small number of speculative defaults lead to forced liquidations.

Since the marginal speculators helped drive prices skyward, its no surprise that the double whack of the loss of speculative buying plus forced selling can impact a neighborhood or even a region (I'm thinking Miami condos and houses in las Vegas) quite strongly. The key determinant as to the impact on a region will be the percentage of people whose "mortgage exceeds the value of their homes, or whose debt payments exceeds 40 percent of incomes." These people may be unable to refinance, and will be ripe for foreclosure.

Note that mortgage delinquencies and foreclosures remain low nationwide, including the areas where prices appreciated the most.

I have only one word. BOHICA.